Service line coverage is a specific policy that not many homeowners think about when purchasing a new home to live. However, homeowners are financially responsible for any incident on their property. The public works department manages utilities, but homeowners have to pay for maintenance. A standard homeowners insurance policy often won’t cover damage to a service line. Find out why you should consider service line coverage to supplement your existing policy.

What’s Covered?

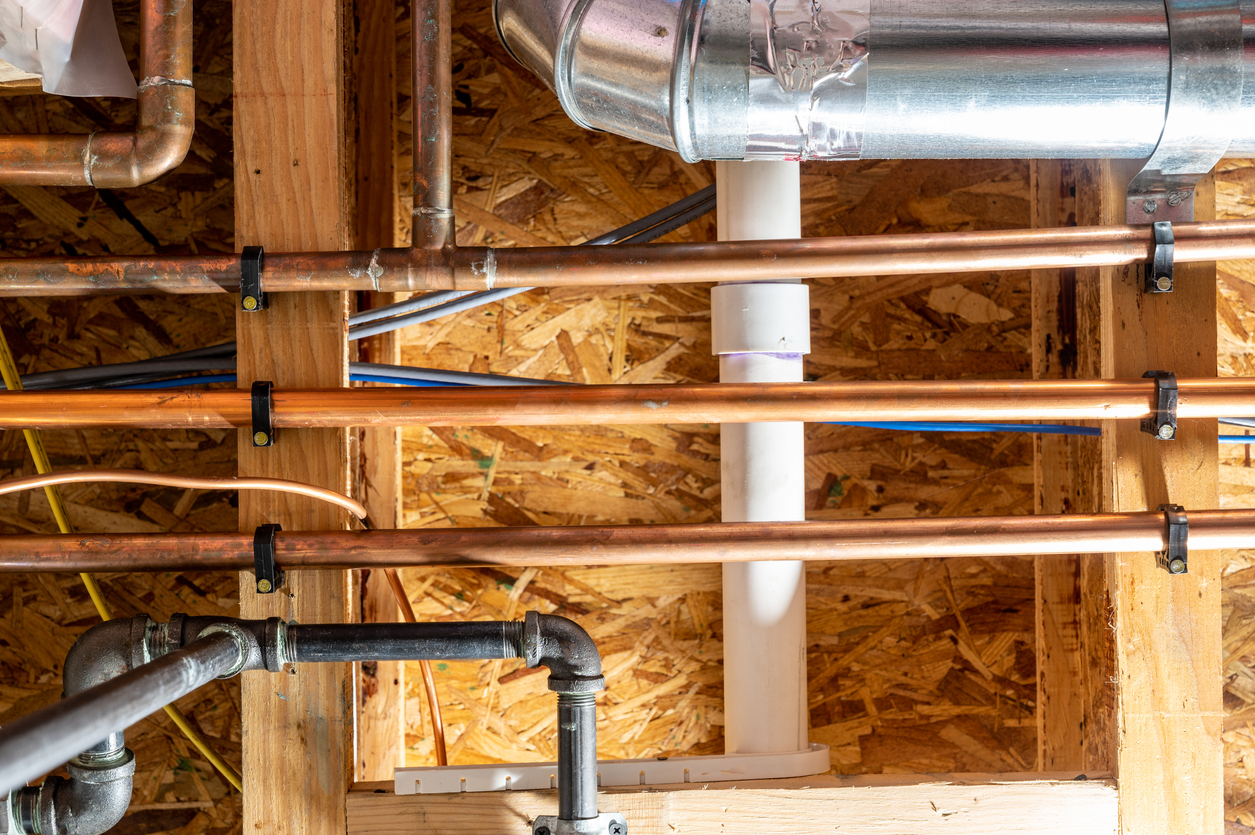

Service line coverage is an endorsement you can add to homeowners insurance. Alternatively, it covers the expenses and damages from a damaged utility line. It includes utilities such as sewage, electricity, power, gas, water, and communications. Also, if any of these lines get damaged, it’s imperative to get them repaired as soon as possible. You can’t live without hot water or a sewage connection. Service line insurance can help you avoid paying this cost upfront.

Who Needs It?

Unless you’re living off the grid, you should invest in service line coverage. In addition to the wide breadth of coverage it provides, it’s notable for being a great value to homeowners. If you add it to your existing policy, there are endorsement options that can fit nearly any budget. It makes it a wise investment, given the potential expense that a broken utility line could incur. Repairing your home’s main water line could cost an average of $933 — or up to $1,529, for example. Service line coverage can shield you from this cost and ensure that contractors finish the repairs on time.

When Would I Need It?

You might not anticipate a broken utility line, but nobody ever does. Despite this, it happens every day, wreaking havoc on homeowners. Also, many culprits can cause the problem. When temperatures drop below freezing in the winter, a frozen pipe could cause your main water line to burst. Similarly, a gas line could leak or break if its connections have sustained too much wear and tear. It can happen at any time simply due to age. In addition to the apparent increased risk of fire, a gas leak can cause natural gas poisoning.

What Exclusions Apply?

A service line policy will typically include some exclusions that homeowners should know. However, relocating pipes or wires is usually not covered unless the relocation is necessary due to damage. Septic systems, water wells, and pumps typically do not receive coverage. Many policies also indicate an exclusion for any piping or wiring routed through a body of water or building.

About E.J. O’Neil Insurance Agency

Since 1898, E.J. O’Neil Insurance Agency has provided homeowners with reliable coverage and high-quality customer service. Today, we offer a variety of policies, including commercial, boat, automobile, homeowners, motorcycle and renters insurance. Quotes are free by phone or online request, and we can provide notary and other services at our location. We pride ourselves on caring for customers when they need it most, proving it with over $3.2 million in claims paid over 12 months. To find the right coverage for your need, call 413-594-4757 or visit us online.